This website contains legacy information on the Non-habitual tax resident (NHR) regime has been revoked with effect from January 1, 2024, onwards, as per the Portuguese Budget Law for 2024.

If you want to know more about the IFICI+ (Incentivo Fiscal à Investigação Científica e Inovação - "Tax Incentive for Scientific Research and Innovation"), sometimes also called as Non-Habitual Resident (NHR) 2.0 or New Inpatriate Regime (NIR), please find the link to our presentation on the NIR, which has now been fully implemented (law, ministerial orders, tax administration guidance, lists of qualifying activities, forms, IT system).

Currently, there is also a tax benefit in place for people who (i) became/become tax resident in Portugal until 2026 (ii) have been previously tax resident in Portugal and left before a certain date; (iii) have not been tax resident in Portugal during the 3 years prior to the new residence; (iv) have their Portuguese tax obligations in good standing and (v) have not applied for the NHR regime.

Other current main features are:

• The benefit corresponds to a cut in half of the tax base (not to be confused with tax rates) applicable to all employment and self-employment income earned (from foreign and Portuguese source);

• No reduced rate as the general and progressive rates apply instead;

• No need to register for it. One can apply for its benefits while filling the tax return;

• No need to perform a specific activity to be eligible.

The benefit: (a) lasts during a period of 5 years and (b) the 50% reduction of the taxable base is limited to the first € 250,000 of income from employment and self-employment income. It is still necessary to have the Portuguese tax obligations in good standing and not apply for the NHR or the NIR. A Parliamentary amendment clarified that it is still necessary to have been resident in Portugal before; on the other hand, the applicant must not have been resident in Portugal during the 5 years prior to entry into this regime.

The “ex-residents” regime may be a viable option for newcomers obtaining employment or self-employment income either abroad or in Portugal.

If you are still interested in our Family Office services please scroll down below.

RPBA is pleased to present this microsite on Family Office Services, one of our niche practice areas.

RPBA has been involved in their structuring and managing, either on the real estate or on the financial angle, by the use of holding and operational companies, trusts, private and family foundations, life insurance, wills, shareholders’ agreements and family protocols.

Due to the increasing demand for these services RPBA felt the need to create a microsite with specific materials on this subject.

Feel free to explore our Family Office microsite.

RPBA lawyers have an in-depth knowledge and expertise in Personal Residence Planning. Click here to learn more...

The Portuguese non-habitual tax resident regime enables a very attractive taxation for global High Net Worth individuals. Click here to learn more...

The Portuguese Golden Visa for non-EU investors grants access to the entire Schengen Area. Click here to learn more...

The Madeira Free Zone provides many interesting tax structuring opportunities. Click here to learn more...

Real Estate Tax Structuring is crucial on the acquisition of high-end real estate by non-Portuguese residents. Click here to learn more...

The “Family Office Report” states: “A family office is a 360 degree financial and wealth management firm and personal CFO for the ultra-affluent, often providing investment, charitable giving, budgeting, insurance, taxation, and multi-generational guidance to an individual or family”.

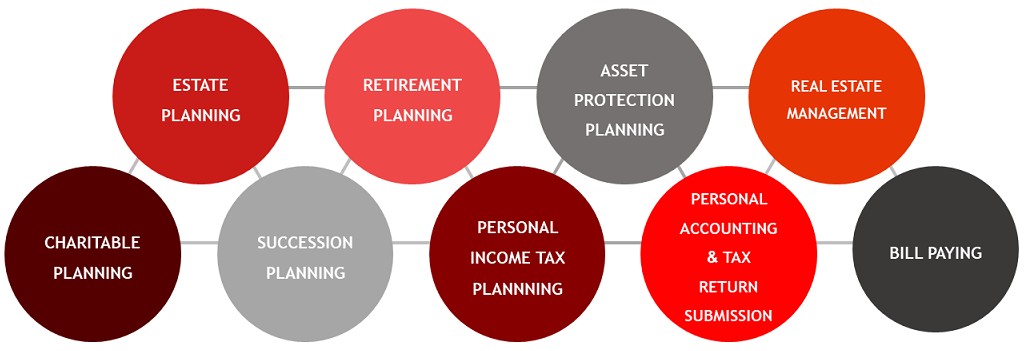

We favor a simpler, plain vanilla, definition: “A Family Office is an office for the management of family affairs”. From our experience the “wealth management” factor is the one most associated with Family Offices by the industry literature. However, there is a plethora of services that may be provided by a Family Office:

Single Family Offices cater for the needs of a single family, and are therefore privacy conscious and focused, providing tailor-made solutions, although they are generally more expensive to run. Multi-family offices serve several clients, and tend to provide economies of scale, more diversified services and increased pooling of know-how due to the experience of working with different families.

Virtual Family Offices spare the office element, being basically a self-managed network of outsourced professionals (accountant, lawyer, wealth manager, etc.). Traditional Family Offices have dedicated staff and are more brick and mortar in format, although sometimes their headquarters is just an office room inside a family member's home.

Most Family Offices are still top structured around one company, either holding or operational. However, most Family Offices develop non-profit(able) activities for the Family like life management or philanthropy. Therefore, the most flexible tools for Family Office umbrella structuring tend to be non-company ones: (i) The Family or Private Interest Foundation or Trust (for instance in Malta or in Liechtenstein); (ii) the Trust (for instance in Malta, Canada or the United States of America); (iii) Life Insurance (for instance in Luxembourg, Ireland and Switzerland).

There are many sound non-tax reasons to consider taking personal residence in Portugal.

The cherries on top of the cake are that:

the Portuguese Non-Habitual Tax Resident regime grants an exemption on foreign source income as well as a limited taxation on income deriving from high value added activities [for more information on this please read our Newsletter (English]);

In particular, the Portuguese Non-Habitual Tax Resident regime provides generous exemptions for foreign-sourced income and a reduced 20% rate for income from high value added activities.

Since 1 January 2004 close family (spouses, children, grandchildren, parents and grandparents) is exempt from Stamp Tax on gifts and inheritances.

Moreover, the disposal of foreign assets (even towards Portuguese residents) as well as, in certain cases, the disposal of Portuguese assets towards non-Portuguese residents, are not liable to this type of taxation.Finally, Portugal has no wealth tax.

When family residence is considered, Portugal also tends to rank well, being a great place to raise children, due to safety and to both good private or public pediatric healthcare. The fact that in the destinations most favored by expats, like Lisbon, Cascais-Estoril and Algarve, English is widely spoken by the Portuguese tends to facilitate foreigners’ integration, some being able to live decades without learning the native language.

Some of the drivers of personal residence may also prove to be key factors for HNWI that are moving to Portugal to consider locating part of their dedicated Family Offices here.

Portugal has relatively cheap real estate (although tax structuring is vital as this is an overtaxed sector), namely office space, an excellent telecommunication infrastructure and educated, qualified and affordable professionals. Its location at the south of Europe, in the tip of the Mediterranean Sea and bordering the Atlantic Ocean, as well the 300 daily flights from Portugal to foreign countries make it an ideal place for globetrotters.

Its several seaports and marinas and its Exclusive Economic Zone, a sea zone of 1,727,408 km2 (the 3rd largest of the European Union and the 11th largest in the world), as well as its 31 airports and aerodromes, make it a natural choice for recreational yachting and private jet travel.

Lawyers by definition have a fiduciary duty towards their clients. Lawyers are trained and ethically oriented by their Bar Associations to act at all times for the sole benefit and interest of their clients, not taking advantage of the position of vulnerability of those who trust them, and honouring the vesting of confidence, good faith and reliance in their aid, advice and protection.

Acting as trusted counsellors, lawyers are in many instances better aware of the family dynamics than anyone else and are therefore in a position to provide sound advice on issues like drafting the Family Constitution.

Lawyers on their own can perform many services in a Family Office context, namely providing legal and tax structuring and advice, but also reporting and record keeping, compliance and regulatory assistance, as well as, in many instances, real estate management (in particular of leased assets). Their role in carrying out the intent of the deceased tends to be crucial in ensuring the intergenerational wealth succession.

From our experience, the attorney-client traditional privilege and trust and the ability to avoid conflicts of interest and self-profit at the expense of his customer makes the lawyer a natural Family Officer, sometimes even a strong candidate for Chief Family Officer.

One of RPBA's expertise services is Family Offices. We are involved in their structuring and managing, both on the financial and real estate angles, by the use of holding and operational companies (namely in Portugal - in particular through the

Madeira Free Zone -, Belgium, Luxembourg and Malta), trusts, private interest and family foundations (namely in Malta and Liechtenstein), life insurance, wills, shareholders’ agreements and family constitutions or protocols.

If you are interested in becoming a Client please e-mail us to communication@rpba.pt

Meet our dedicated team and our purpose on our Main Website.

You can reach us at

communication@rpba.pt

(+351) 212 402 743

Share this page